Most Common Questions

1I do have insurance. Why did I get this notice?

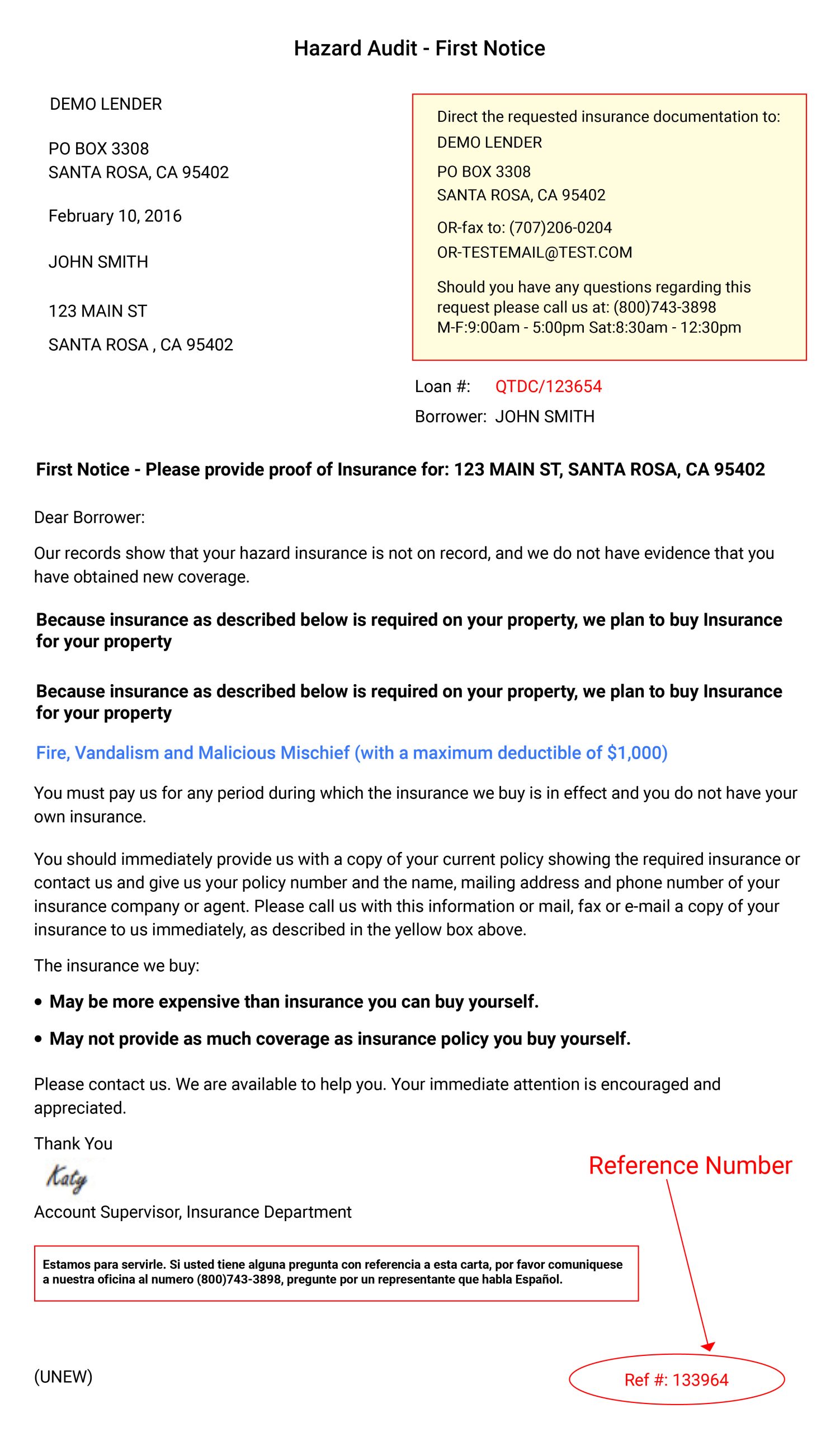

This notice was sent because we have not received a copy of your current proof of insurance. Typically, your insurance agent or company sends us a copy of your policy. We may not have received your insurance policy because we are not listed as Loss Payee or our address is incorrect. Our correct address is listed in the upper right-hand corner of the notice we sent to you. Or you may have received this notice because the auto insurance policy sent to us had only liability coverage, not the required physical damage coverage, or is deficient in some other manner. If your notice states that your insurance has expired, we have not received a copy of the renewal. If your notice states that your insurance has been canceled, we have not received a copy of the reinstatement. If you have insurance with the required coverage, naming us as loss payee or mortgagee, please login and provide us with your insurance information.

2How can I provide you with my insurance coverage information?

1. You can login and provide us with your insurance information and we will contact your agent to verify your coverage and obtain a copy of your policy.

2. You or your agent may contact the Insurance Department using the number listed on the notice you received.

3. You or your insurance agent can mail, fax or e-mail a copy of your current insurance policy to us. Our mailing and e-mail addresses and fax number are listed in the upper right-hand corner of the notice we sent you.

3Why do I need to provide my insurance information?

As one of the conditions of granting your loan, you are required to maintain comprehensive and collision for your vehicle loan and hazard insurance for your real estate secured loan. This coverage will protect our interest in the collateral that secures your loan until your loan is paid in full. You will find this requirement in your Loan Agreement. By giving your insurance agent our name and address as loss payee or mortgagee, we will receive a copy of any change to your coverage. A letter was sent to you because we did not receive a copy of your policy, your policy renewal or reinstatement from your insurance agent or company. We are asking for your help to show us that you are meeting the insurance requirements of your loan. If you have insurance with the required coverage, naming us as Loss Payee or mortgagee, please go to our Insurance Verification Form and provide us with your insurance data.

4What Is Acceptable Insurance?

You will need to provide proof of comprehensive and collision insurance for your vehicle loan, fire, vandalism and malicious mischief insurance for your real estate secured loan or business personal property insurance for your business equipment loan. Furthermore, your policy will need to include the policy number, the effective and expiration date of your policy, the insurance company name, the actual coverages provided, any limits of insurance, the amount of your deductible and the name of the loss payee or mortgagee. Note: Insurance ID cards are not acceptable as proof of insurance.

5What should I do if I don't have insurance?

Stop what you’re doing and go get your own insurance. Keeping your own insurance coverage in force at all times is a requirement of your loan with us and just a good practical personal financial practice. You should contact the insurance agency or company of your choice and obtain your own coverage that will meet the requirements of your loan. In addition, your insurance agent or company can recommend other coverages that will satisfy local and state requirements for liability insurance as well as protecting your other assets.

6What happens if I don't get my own insurance?

If you do not buy your own insurance, we may buy insurance to protect our collateral and pass along the cost to you. The insurance we buy will generally be much more expensive than what you can buy yourself. The loan agreement that you signed with us allows us to buy the insurance, add the premium for the insurance to your loan and increase your payments to cover the cost. The insurance we purchase will primarily cover our interest in your collateral and will not insure any equity you may have in the collateral. It will not offer you the broad protection you can get when you buy your own insurance. The insurance we purchase will not provide liability coverage which the state requires you to maintain. We strongly urge you to purchase your own insurance.

7What is Force-Placed or Lender-Placed Insurance?

When your insurance coverage has lapsed, is insufficient, has been canceled or has not been received, as a last resort, your lender will obtain coverage on your collateral through a selected insurance company. Lender-placed insurance is almost always more expensive than insurance coverage you can purchase yourself, and the coverage is typically less than what you can obtain on your own insurance policy.

8May I change my insurance companies during the term of my loan?

At any time, you can choose whatever insurance company you want as long as it meets or exceeds the insurance requirements of your loan. You can’t allow your coverage to lapse or be out of force at any time. If you do, you may incur charges for any period when you did not have your own insurance coverage. Please make sure you let your agent or insurance company know that your lender must be listed on your policy as loss payee or mortgagee.

9My mailing address has changed. How do I let you know of the change?

Please call your lender to report any changes to your contact information.

10What do I do if I receive an insurance claim check?

In the event your insurance company has processed your claim and has issued you a loss claim, you will need to provide that claim settlement to your lender.

11Do I have to carry Flood Insurance?

If your property lies within Flood Zone "A" or "V", federal law requires you to maintain and provide proof of flood insurance coverage. If there are any changes in your flood zone, your lender will notify you and you may be required to then obtain flood insurance. Why is my lender now requiring me to obtain or increase my flood coverage? FEMA has made it a requirement of any federally insured financial institution to first determine if the real estate they are lending on is in a flood zone. If the property is in a flood zone, the lending institution then requires you to maintain flood insurance until the loan is paid or the property is no longer in a flood zone. FEMA is constantly updating flood maps and your property’s flood zone may have recently changed and is now in a flood zone. Consequently, you now have to obtain flood insurance and provide proof of flood insurance to your lender.

12What do I do if I disagree with the amount of flood coverage that my lender is requiring?

We encourage you to speak to your local insurance agent to verify that the coverage you currently have will completely cover the cost to rebuild / replace your home in the event of a flood loss. If your insurance agent can provide proof that your current coverage will replace your home, please have them send the written documentation to your lender for further review.

13What do I do to ensure that I have adequate flood insurance coverage?

Contact your local insurance agent to verify your coverage meets the minimum flood insurance requirements. They are the lesser of:

• 100% of the replacement cost of your dwelling/structure.

• The maximum insurance available through the National Flood Insurance Program (NFIP), which is currently $250,000.00 for residential properties and $500,000.00 for commercial real estate.

If your coverage is less than what is required, you would have a gap, and your lender may place lender placed flood gap on your account if you do not increase your coverage.

14My home has never flooded. Why do I need flood insurance coverage?

Being in a flood zone means there is the risk that your property may experience flooding. In the unlikely event that this would happen, the lender and the borrower must be insured. It is in your best interest to insure yourself from a loss due to flooding if you are in a flood zone.